Nash自撰的" Nash equilibrium"的論文,中國有譯本。

Sep 6th 2016, 23:00 BY S.K.

This week “The Economist explains” is given over to economics. For each of six days until Saturday this blog will publish a short explainer on a seminal idea.

ECONOMISTS can usually explain the past and sometimes predict the future—but not without help. One of the most important tools at their disposal is the Nash equilibrium, named after John Nash, who won a Nobel prize in 1994 for its discovery. This simple concept helps economists work out how competing companies set their prices, how governments should design auctions to squeeze the most from bidders and how to explain the sometimes self-defeating decisions that groups make. What is the Nash equilibrium, and why does it matter?

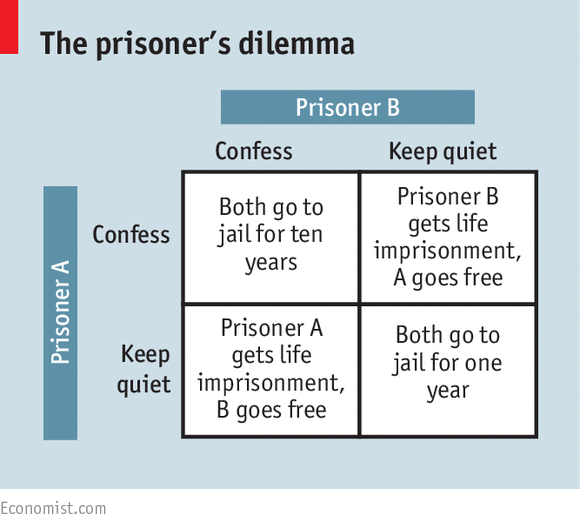

One of the best-known illustrations is the prisoner’s dilemma: two criminals in separate prison cells face the same offer from the public prosecutor. If they both confess to a bloody murder, they each face ten years in jail. If one stays quiet while the other confesses, then the snitch will get to go free, while the other will face a lifetime in jail. And if both hold their tongue, then they each face a minor charge, and only a year in the clink. Collectively, it would be best for both to keep quiet. But given the set-up, an economist armed with the concept of the Nash equilibrium would predict the opposite: the only stable outcome is for both to confess.

In a Nash equilibrium, every person in a group makes the best decision for herself, based on what she thinks the others will do. And no-one can do better by changing strategy: every member of the group is doing as well as they possibly can. In the case of the prisoners' dilemma, keeping quiet is never a good idea, whatever the other mobster chooses. Since one suspect might have spilled the beans, snitching avoids a lifetime in jail for the other. And if the other does keep quiet, then confessing sets him free. Applied to the real world, economists use the Nash equilibrium to predict how companies will respond to their competitors’ prices. Two large companies setting pricing strategies to compete against each other will probably squeeze customers harder than they could if they each faced thousands of competitors.

The Nash equilibrium helps economists understand how decisions that are good for the individual can be terrible for the group. This tragedy of the commons explains why we overfish the seas, and why we emit too much carbon into the atmosphere. Everyone would be better off if only we could agree to show some restraint. But given what everyone else is doing, fishing or gas-guzzling makes individual sense. As well as explaining doom and gloom, it also helps policymakers come up with solutions to tricky problems. Armed with the Nash equilibrium, economics geeks claim to have raised billions for the public purse. In 2000 the British government used their help to design a special auction that sold off its 3G mobile-telecoms operating licences for a cool £22.5 billion ($35.4 billion). Their trick was to treat the auction as a game, and tweak the rules so that the best strategy for bidders was to make bullish bids (the winning bidders were less than pleased with the outcome). Today the Nash equilibrium underpins modern microeconomics (though with some refinements). Given that it promises economists the power to pick winners and losers, it is easy to see why.

Coming up

Thursday: The Keynesian multiplier

Friday: Minsky's financial cycle

Saturday: The Mundell-Fleming trilemma

Thursday: The Keynesian multiplier

Friday: Minsky's financial cycle

Saturday: The Mundell-Fleming trilemma